Beneficiary Claims Case Study

Creating ease in navigating the emotional process of redistributing assets after a death

Simplifying Beneficiary Claim Processes

Losing a loved one is hard, and dealing with the paperwork that comes after can be even tougher. Handling a beneficiary claim when someone passes away is complicated and emotional. It's important to be understanding of the feelings of those making the claim and to know how finances work.

While some companies try to make this process easier for their clients, there's still a big challenge— the tools and systems used internally by financial experts to help with these claims. These tools are crucial for making things easier for the beneficiaries who are already dealing with sadness and grief.

As a UX Designer with experience in customer service and making processes better, I know how vital it is to create easy-to-use and caring solutions for this sensitive issue. By creating user-friendly internal tools designed specifically for financial experts handling these claims, we can improve the experience for beneficiaries and provide the support they need during this tough time.

By working together, using smart design, and truly understanding what financial experts and beneficiaries need, we can make the process of dealing with beneficiary claims after a loved one's passing simpler and more compassionate.

Problem Statement

Users processing beneficiary claims are frustrated when determining the requirements and necessary steps between custodians, money managers, and the beneficiaries’ intentions for the assets.

Objectives & Goals

Define a series of processes for each time of claim that works in accordance with SEC regulations and custodial guidelines

Discover

Our Process

Define

Product Users

Financial professionals assisting with beneficiary processes

Financial Advisors

Advisor Success Representatives

Sales Representatives

Customer Support Representatives

Beneficiaries

Investors

Quantitative Research

The purpose of doing user surveys for this project was to examine the difficulties users felt when processing beneficiary claims. We focused on surveying people who regularly processed claims in a call center phone queue for a money management company.

Screeners

What resources do you find most helpful when helping an advisor navigate a beneficiary claim?

Which custodian do you feel is the easiest to work with in the beneficiary claim process?

Which Beneficiary Claim type would be the most helpful to review?

Which Beneficiary Claim type do you feel most confident processing?

What specific situations that may have caused unexpected NIGOs?

What do you feel is the most challenging part of the death claim process?

How do you feel we could better set advisors up for success in navigating claims?

How could we provide more consistency in the beneficiary claim process when advisors call into our service line?

What do you feel would be most helpful in understanding how to help advisors?

Do you have any suggestions that you feel would improve the process?

Please share any feedback you've received from advisors when processing beneficiary claims (positive or negative):

Observations

58%

users felt the best resource for establishing the process was the client-facing Help Center

67%

Craft a way for financial professionals to navigate the processes that provides all necessary components

Ideate

100%

NAME:

AGE:

EDUCATION:

JOB

LOCATION:

HOBBIES

Jenny Levine

33

University of Chicago

Customer Service Rep

Boston, MA

Dancing and Running

found the most difficult claims to be those without beneficiaries that required legal action to establish estates

believe that we can improve the process by having better internal and external resources

Design

Personality

-Empathetic

-Creative

-Detail-oriented

-Hardworking

Goals

-Provide all of the process and requirements to clients to ease their claim experience

-Be able to quickly access resources while both on-call and in email correspondence

-Have a reference that is easily navigable through all different scenarios of claims

felt that we could better set up advisors for success by providing more automated processes

“Advisors’ number one complaint is that the process is too slow and inconsistent.”

“We can provide more consistency in the beneficiary claim process when advisors call into the service line by walking the caller through where to locate information in the Help Center.

Advisors should be able to reference needed materials on the website.”

80%

User Needs

Persona

Internal and external resources that clearly define process for a wide variety of beneficiary claims

Increased knowledge of process to be able to provide quick answers

Consistency in process knowledge and case handling for quicker resolve for advisors

Focus on clarity and speed of completion

Competitive Analysis

Vanguard

Rating: 1.05/5 on Better Business Bureau (Not Accredited)

Vanguard's low-cost model and large fund selection make the broker a good choice for long-term investors, but the firm lacks the kind of robust trading platform active traders require.

Claim process initiated by beneficiary through website.

Features:

Detailed process explanations

Guided drop down menus for gathering information

Identification verification through ID upload

Task: Walk an advisor through a claim

Feelings

Thoughts

Improvement Opportunities

Principal

Rating: 1.04/5 on Better Business Bureau

Principal offers a wide variety of products and services: life and health insurance, banking, investment opportunities, mortgages, and group benefits. Certain processes require customer service calls and traditional mail. Large amount of online complaints from investors regarding negative experiences.

Claim process initiated by beneficiary through website and completed over phone.

Features:

Very simple information gathering - only three screens total

Final page details required downloadable forms for claim

Detailed next steps for beneficiary to call in claim

Bio

Jenny spends her day working from home for a financial company call center, where she needs to understand many different scenarios. She aims to provide the most thorough information to clients with the least amount of effort required on their end.

Pain Points

-Limited knowledge of industry

-Inconsistent resources and training

-Working with multiple companies creates confusion of workflows

-Dealing with sensitive situations requires more handling finesse

Journey Map

Persona: Jenny Levine

Goal: To easily assist clients in navigating beneficiary claims on a phone line

Step 1

Compile claim information

frustrated

What questions do I need to ask to get to the right one?

Have a quick reference to walk through initial information gathering

Wireframes

Step 2

Perform account maintenance

okay

Which type of account needs action?

Understand which accounts need restriction according to SEC

Step 3

Provide relevant process for next steps

overwhelmed

How do I provide steps if we are unsure of intentions?

Have processes defined for each claim type and easily navigable for all beneficary intentions

Step 4

Share any forms and documentation required

tedious

I need to find the best way to share the information

Have a list of all documents including links/PDFs for quick access

Solution

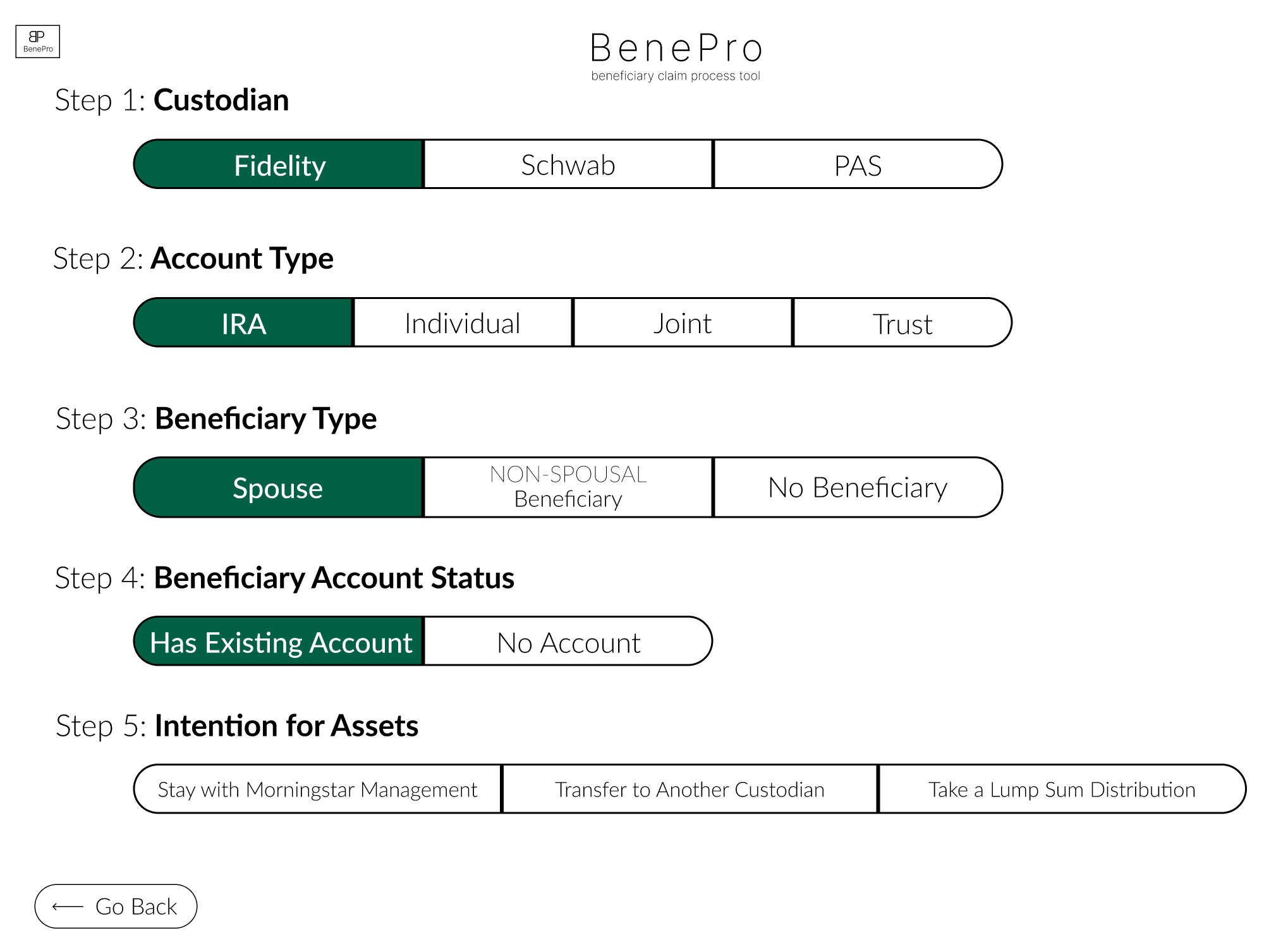

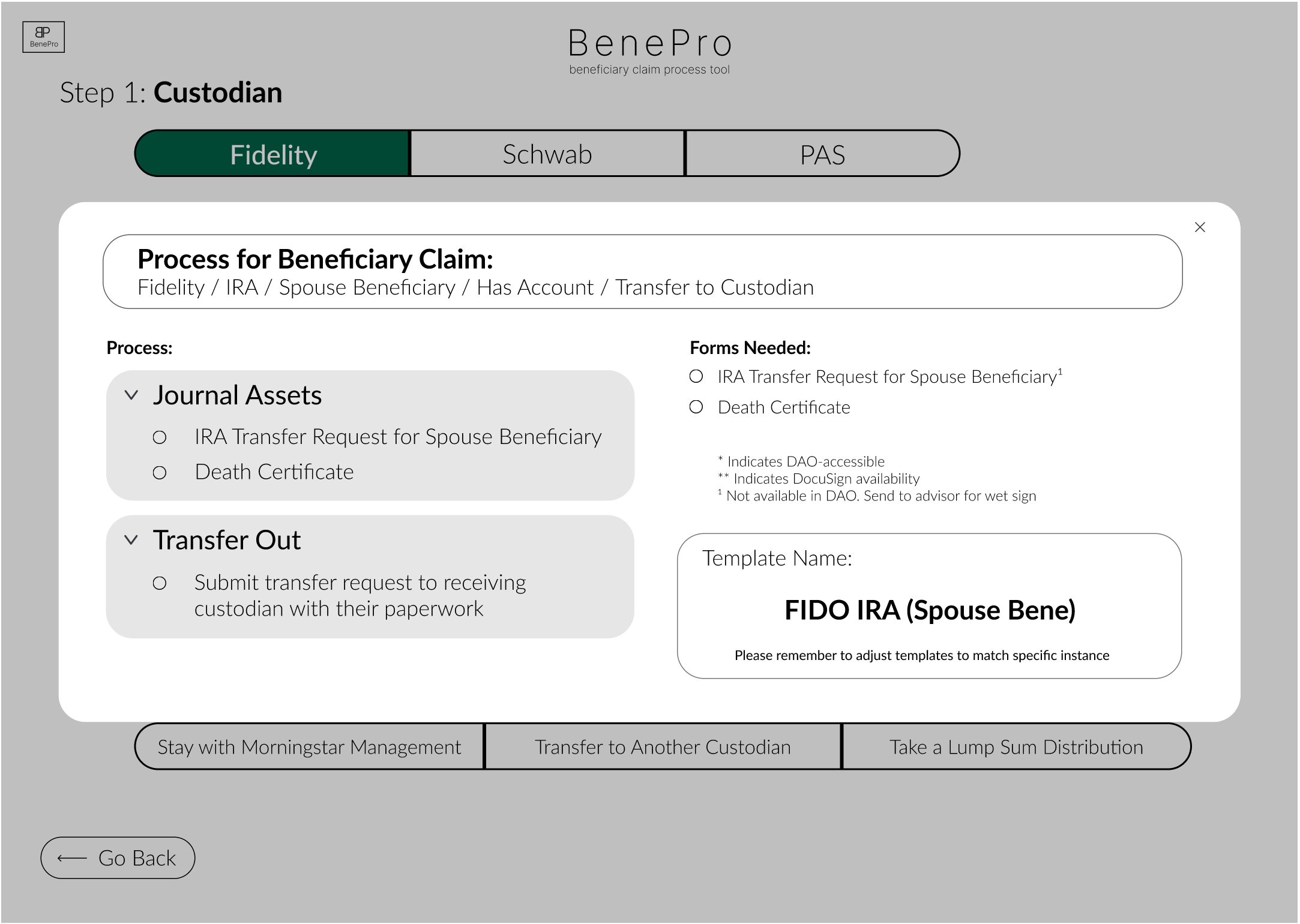

Create a reference tool that will assist representatives in walking through required questions to lead to the correct claim process

Clarify process by defining steps and documentation with a clear presentation

Provide ability to access all required documentation to generate for advisor/client access

Define each step needed for each account type to ensure SEC regulations are enforced